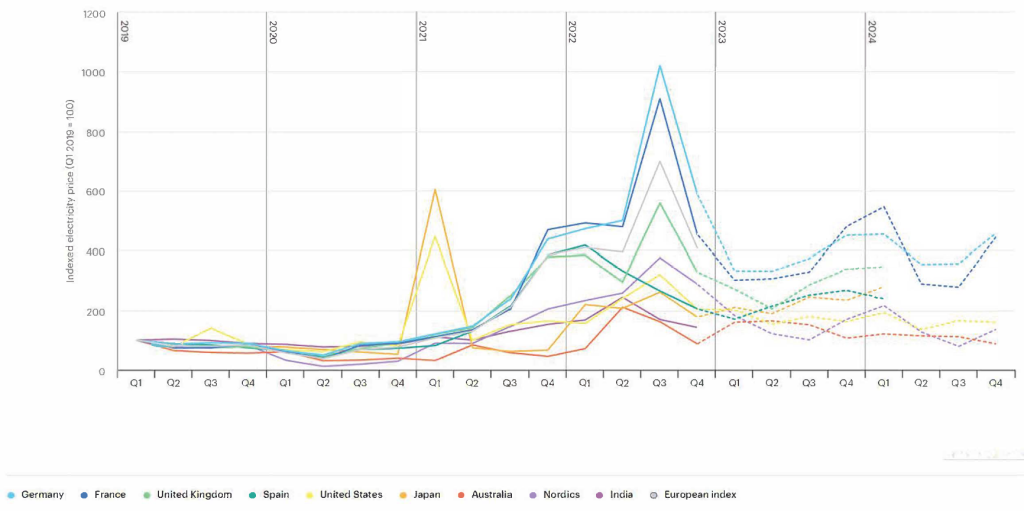

The third quarter of 2022 was marked by further reductions and then a complete interruption of gas supply from the North Stream 1 gas pipeline at the beginning of September. The resulting high gas prices, combined with reduced availability of nuclear power plants and weak hydroelectric production due to droughts, have put additional pressure on an already tight wholesale electricity market. The European electricity benchmark averaged €339/MWh in the third quarter of 2022, 222% higher than in the third quarter of 2021.

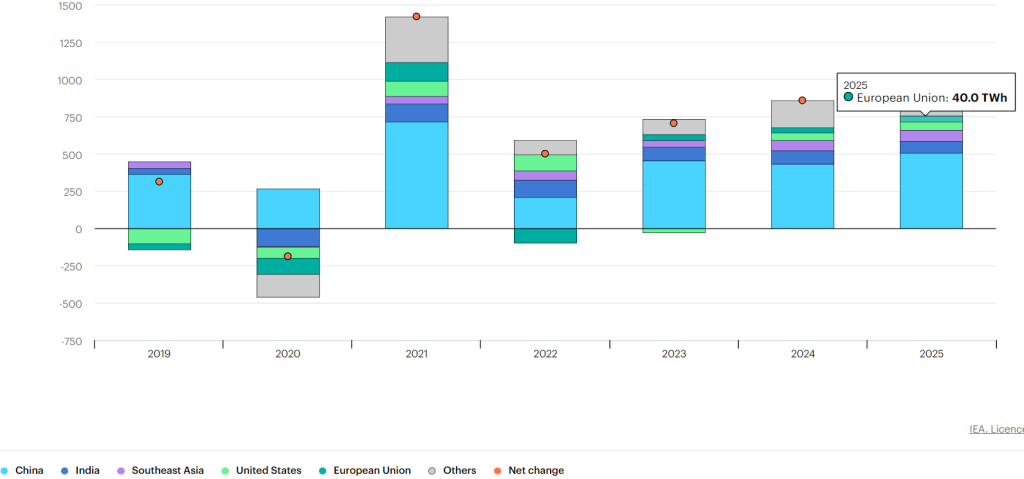

Year-on-year change in electricity demand by region, 2019-2025

Prices rose significantly in almost all markets in Europe (price changes ranged from 25% to more than 300%). The highest year-on-year price growth in EU countries was recorded in France (+342%), Austria (312%) and Slovakia (+310%). Italy and Malta (472 and 460 €/MWh respectively) 279% and 238% more than in the third quarter of 2021.

In the third quarter of 2022, the share of renewable energy sources managed to increase its share to 49%. The production of renewable energy sources improved its production by 1% (+3 TWh) on an annual basis. This is the result of an increase in solar production of 28% (+16 TWh) and 7% of onshore wind power (+4 TWh). Reduced levels of nuclear (-41 TWh) and hydropower (-17 TWh) production enabled an 11% increase in fossil fuel production (+24 TWh) on an annual basis, despite high energy prices.

New emergency policy measures were introduced to tackle high electricity prices, including demand reduction measures and a temporary income cap for inframarginal electricity producers. Retail electricity prices for households in EU capitals increased by 49% in November 2022 compared to the same month in 2021. The highest price increases in EU member states were recorded in Italy (+64%), Belgium (+ 59%) and Germany (+58%).

Indexed quarterly average wholesale prices for selected regions, 2019-2024